Over the last five years we have written many articles about the positive uses of trusts.

Trusts can be used to do many great things including;

- solving inheritance problems – especially for ‘complicated families’

- protecting children from others, and sometimes also from themselves

- protecting family assets from business and other risks

- owning family businesses

- passing business smoothly from one generation to the next – avoiding family conflict and business disruption

- caring for disabled children

- charitable purposes

- and many others

However, we thought it might also be helpful to make a list of things that trusts should not be used for.

We are prompted to do this partly to help remove some confusion about trusts, and partly also because we have noticed some people marketing trusts as offering benefits which in reality simply do not work.

So here is our list of things you should not use Czech trusts for:

1. Tax ‘Optimisation’

In many other countries trusts offer some very helpful tax benefits. In a few countries trusts are not taxed at all. In other countries, it is possible for example to use trusts to spread income around family members without actually paying it out. This means that you can take advantage of children’s lower tax rates to reduce the overall family tax burden.

None of these benefits apply in the Czech Republic.

There can be a few very small potential tax benefits associated with holding the shareholding of a family company through a trust, but these would only ever be an ‘extra positive’ rather than the main motivation for doing something.

What about using international trusts for tax optimisation? Generally speaking, this is quite complicated and expensive and for most people, it will deliver limited, if any, benefit. That is because most gains generated in the Czech Republic and all income received here will still be taxable here. In fact, if done incorrectly, using international trusts can sometimes deliver a far worse result than doing nothing.

2. Owning Investments

A number of financial advisers and others are suggesting that Czech Trusts are a good tool for holding investments (investment portfolios, investment real estate etc). This is not correct.

A number of financial advisers and others are suggesting that Czech Trusts are a good tool for holding investments (investment portfolios, investment real estate etc). This is not correct.

The reason is simple. If you own an investment asset directly, you will pay tax on your earnings from that investment at 15%. If you own the investment via a trust, the trust will pay 19% and then, when it distributes the money to you, you will pay another 15%. That comes to a total of 31.15%. (It is not 19% + 15% = 34% because the 15% is only charged on the net amount.

So, unless there are very compelling other reasons for setting up the trust, we don’t recommend using a Czech Trust for holding assets in this way.

Some companies are suggesting that you can place your investment assets in your trust but leave the returns from those investments outside the trust. Such strategies are potentially very risky for clients and run a high risk they could be considered tax avoidance or even tax evasion. If someone is trying to convince you that this strategy works, you should insist on seeing a written opinion from a tax adviser confirming that it is OK. If they cannot show it to you, walk away.

If your investment portfolio is substantial (meaning >20 million CZK) then in some circumstances it IS possible to implement a structure using international tools to hold your investments in trust. However, as we mentioned above, this will not reduce your tax to zero, but it will keep the tax to 15% when you receive the money. The reason for the 20 million limit is that the costs of setting up such a structure are quite high, and not justified for lower amounts.

3. Defrauding Creditors / Defrauding the ‘Future ex Wife’

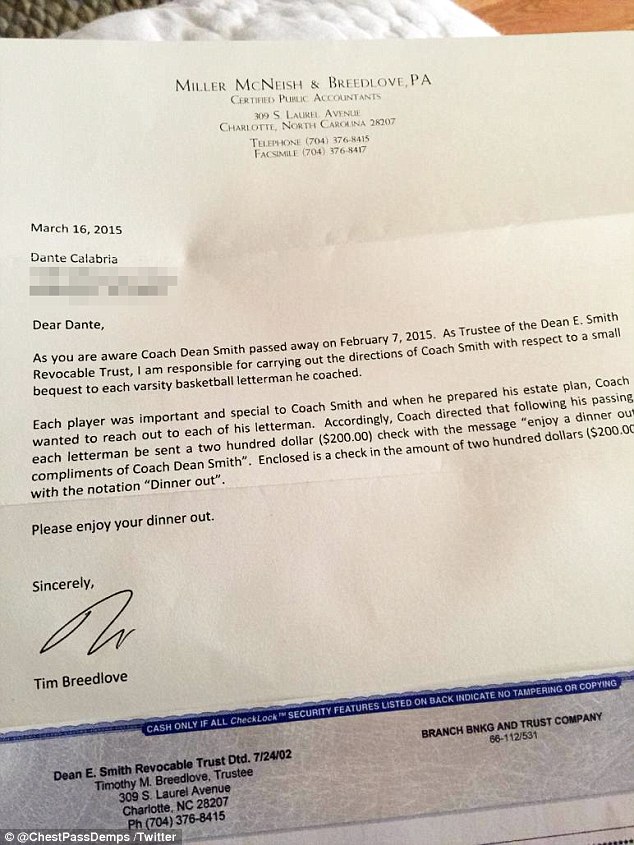

As we frequently emphasise, one of the main benefits of trusts is that the assets you place in the trust are no longer yours.

This is very useful if, in the future, you come under personal financial attack from creditors or others. We strongly encourage people in high risk jobs (company directors, property developers, surgeons etc) to protect their families.

The important thing though is to set up the protection structure ‘while the sun is shining’. By setting up the trust, you are protecting your family against future risks and if a creditor decides to lend you money at a time when your trust already exists, he can hardly complain about it later.

However, if you wait until it’s ‘raining’ it will be too late to buy the umbrella. Czech insolvency law allows creditors and others to ignore transfers to trusts that happened (depending on the circumstances) in the last 2 or 5 years. In addition, any attempt to put assets into a trust in order to deliberately frustrate the interests of a creditor (or future ex-spouse) will also be set aside.

4. Stealing your sibling’s inheritance

We have seen some clients come to us with parents in tow, suggesting that a trust be established in order to make sure all the money goes to that child and not his or her siblings. This can sometimes be entirely fine, but it does sound a few alarm bells in our minds.

We have seen some clients come to us with parents in tow, suggesting that a trust be established in order to make sure all the money goes to that child and not his or her siblings. This can sometimes be entirely fine, but it does sound a few alarm bells in our minds.

Trusts are a great tool for managing the inheritance process, but the trust must always be designed to reflect the true wishes of the founder (in this case the parent). If the parent wants to benefit one child at the expense of the others, that’s not a problem. There are many perfectly legitimate reasons why they might want to do this. However, what is important is that the parent is doing this because THEY WANT TO – not because they are being pressured to do so by children. In cases such as this, we always do our best to ensure that the parents are making their own decision and are not being pressured by children and that the reasons for their decision are logical, and fully documented.

If we are not satisfied that the parent properly understands the implications of what they are doing, or if we suspect there may be undue pressure applied to them, then we will refuse to help establish the trust.

5. Money Laundering / Tunnelling / Other Illegal purposes

We would not accept these people as clients as a matter of practice.

However, we also think they are like Unicorns. A lot of people talk about them, but we have never so far met any of them, and we’re not sure they even exist!

When trusts were first introduced into the Czech Civil Code, there was much discussion, including in the media, about possible or even probable misuse by criminal elements.

We like to liken this to frozen fish:

Frozen fish are highly dangerous and have the potential the potential to kill people if used as a weapon.

Therefore, we should ban frozen fish.

It is true that you could kill someone with a frozen fish*. But of course, this is a silly argument because it ignores the overwhelmingly positive benefits of frozen fish, and also the fact that there are many better ways of killing people than using frozen fish.

Trusts are the same. It is true that you can use Czech trusts to do illegal things, but why would you?

All the parties involved in a Czech Trust are completely transparent to the Czech State

The potential for personal liability and the level of personal responsibility (including criminal liability) placed on trustees is much higher than for companies

There are still, unfortunately, many better tools for doing illegal acts including offshore (and even Czech) companies.

So that’s a summary of some of the reasons for using a trust that just don’t work. There are probably others and we may add to this list in the future.

Like the frozen fish though, there are many many excellent reasons for using trusts, and as time passes people are becoming increasingly aware of them – as evidenced by the doubling of numbers of trusts in the last six months.

* We carefully searched the internet and did not manage to find any actual examples of this (let us know if you do!). Frozen sausages have been used as a weapon (although not to kill). In Roald Dahl’s ‘Lamb to the Slaughter’ a woman killed her husband with a frozen leg of lamb and then cooked it and served it to the detective who came to investigate the crime.

In contrast, the regime changes experienced by the Czech Republic over the past 150 years have played havoc with Czech family businesses. As a result, we now have very few local examples of such multi-generational businesses. One exception is renowned piano maker Petrof, spol. which was nationalised in 1948 but has been back in the hands of the original family since 2001. Other exceptions include the Joch family’s UNESCO World Heritage recognised modrotisk printing business in Strážnice, which was reclaimed by the family in 1994.

In contrast, the regime changes experienced by the Czech Republic over the past 150 years have played havoc with Czech family businesses. As a result, we now have very few local examples of such multi-generational businesses. One exception is renowned piano maker Petrof, spol. which was nationalised in 1948 but has been back in the hands of the original family since 2001. Other exceptions include the Joch family’s UNESCO World Heritage recognised modrotisk printing business in Strážnice, which was reclaimed by the family in 1994.

A number of financial advisers and others are suggesting that Czech Trusts are a good tool for holding investments (investment portfolios, investment real estate etc). This is not correct.

A number of financial advisers and others are suggesting that Czech Trusts are a good tool for holding investments (investment portfolios, investment real estate etc). This is not correct. We have seen some clients come to us with parents in tow, suggesting that a trust be established in order to make sure all the money goes to that child and not his or her siblings. This can sometimes be entirely fine, but it does sound a few alarm bells in our minds.

We have seen some clients come to us with parents in tow, suggesting that a trust be established in order to make sure all the money goes to that child and not his or her siblings. This can sometimes be entirely fine, but it does sound a few alarm bells in our minds.